Why Music Royalties Are a Sound Investment

Investors are increasingly searching for assets that provide resilient cash flows and low correlation to traditional equity and bond markets. While gold, private credit, and real estate often dominate conversations around alternative investments, a different asset class has quietly gained institutional recognition: music royalties.

At Rivers Wealth, the ICM Crescendo Music Royalty Fund is a core component of most of our clients’ portfolios. The Fund provides exposure to a globally diversified portfolio of high-quality music intellectual property and has demonstrated stable, recurring cash flow—regardless of the macroeconomic environment. But what makes music royalties such a compelling investment? Let’s take a closer look.

What Are Music Royalties?

Music royalties are payments made to rights holders—typically songwriters, composers, publishers, or performing artists—whenever their music is used. This usage may come from:

· Streaming platforms (Spotify, Apple Music)

· Radio play and satellite broadcast

· Film, TV, commercial, and brand sync placements

· Social media platforms such as TikTok, YouTube, and Instagram

· Live performance licensing

When you invest in music royalties, you are purchasing the right to receive a portion of the income generated from specific musical works. These are long life assets with little to no maintenance capital required. The low capital-intensity nature of the investment is one of the many attractive attributes of the asset class.

Why Music Royalties Shine in Uncertain Markets

1. Low Correlation to Traditional Markets

One of the most compelling attributes of music royalties is their lack of correlation to public equities and bonds. People listen to music whether markets are rising or falling. Consumption does not depend on interest rates, credit conditions, or economic sentiment.

In fact, global streaming revenue growth has moved independently of stock market cycles, showing no statistical correlation to the S&P 500 based on historical comparison data. This makes music royalties an effective stabilizer in diversified portfolios.

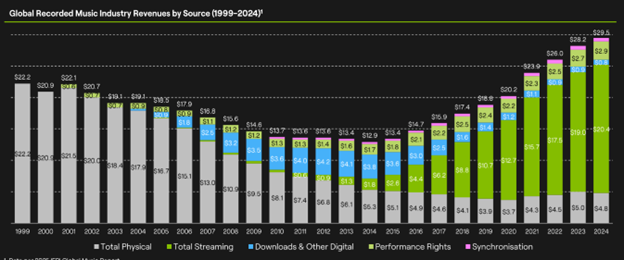

A prime example of royalty resilience took place during the COVID-19 pandemic. Even as global markets declined sharply, music streaming consumption accelerated. The industry grew revenue by 7.4% in 2020, while many traditional asset classes experienced drawdowns.

Royalty holders continued receiving income—demonstrating one of the most attractive features of the asset class: people listen to music in both good times and bad.

Source: Goldman Sachs

2. Consistent, Recurring Cash Flow

Music royalty income is durable and persistent, often lasting for decades beyond a song’s release. Many of the Fund’s catalogues include tracks that:

· Have billions of global streams

· Reappear in seasonal rotations (e.g., holiday music)

· Earn sync placement revenue (licensing for use in TV shows, movies, commercials, and video games)

The ICM Crescendo Music Royalty Fund targets mature songs that have stabilized post initial release and aims to diversify across genre and song age. A timeless catalog earns royalties for the life of the artist plus 70 years—longer than most physical assets last. A few notable artists in the catalogue include Taylor Swift, Beyonce, Justin Bieber, The Lumineers, and Gordon Lightfoot:

Source: ICM Asset Management

3. Exposure to Structural Growth Story - Streaming

We are living in the golden age of music accessibility. Subscription platforms now form the backbone of global listening.

According to the IFPI and Luminate, global streaming volumes continue to grow, with international listening expanding rapidly in markets such as Brazil, Nigeria, India, and the Middle East.

Source: Goldman Sachs

Meanwhile, Goldman Sachs projects the global music industry to more than double, reaching over $200 billion by 2035, driven by streaming adoption and pricing power enhancements among digital streaming platforms.

As services like Spotify and Amazon Music raise subscription prices—while maintaining user growth—royalty holders directly benefit, as price increases formulaically increase royalty payments. Investing in royalties isn’t just an income play—it’s a long-term growth exposure to the expanding digital entertainment economy.

Source: ICM Asset Management

The ICM Crescendo Music Royalty Fund: A Well Constructed Portfolio

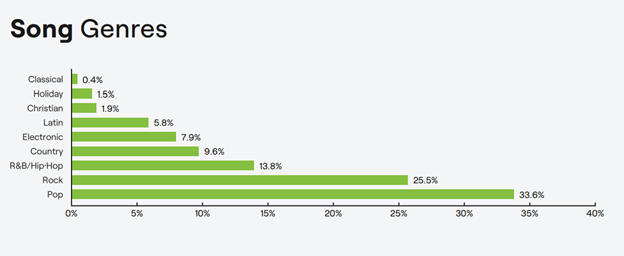

The Fund now holds over 5,000 songs across 35 catalogues, spanning Pop, Rock, R&B/Hip-Hop, EDM, Country, and more.

Source: ICM Asset Management

Source: ICM Asset Management

The result is a globally diversified, professionally managed royalty vehicle similar to infrastructure or private real estate—but with cultural relevance and digital scalability.

It is no surprise that institutional allocators including Blackstone, KKR, Brookfield, Apollo, and PIMCO have increased exposure to intellectual property royalties.

Final Thoughts: Striking the Right Chord

Music is universal. It crosses borders, generations, and economic cycles. As streaming platforms expand and monetize audiences more effectively, the value of high-quality music rights continues to rise.

For investors seeking:

· Stable monthly income

· Reduced portfolio volatility

· Exposure to music consumption growth trends

Music royalties represent a compelling, durable, and increasingly institutionalized asset class.

At Rivers Wealth, we view music royalties not as a niche investment—but as a core portfolio diversifier built to enhance risk-adjusted returns. The Fund targets 7%+ annual cash distributions paid monthly and 10–12% total return.

If you would like to learn more about investing in music royalties, please reach out at adam@rivers-wealth.com.

Also – you can click here to listen to the ICM Crescendo Playlist on Spotify to preview some of the most popular song in the Funds portfolio, and as we enter the holiday season, it is worth highlighting fund’s acquisition in 2025 of certain publishing rights to Mariah Carey’s timeless holiday classic, “All I Want for Christmas Is”.

The song holds the distinction of being the highest-charting holiday song in Billboard history. Its impact extends far beyond streams, with frequent appearances in films, commercials, and holiday programming, cementing its place as a seasonal soundtrack for millions.

So, whether you are fan, or never want to hear the song again by boxing day, know that as an investor in the The ICM Crescendo Music Royalty Fund you earn a little more with each play.